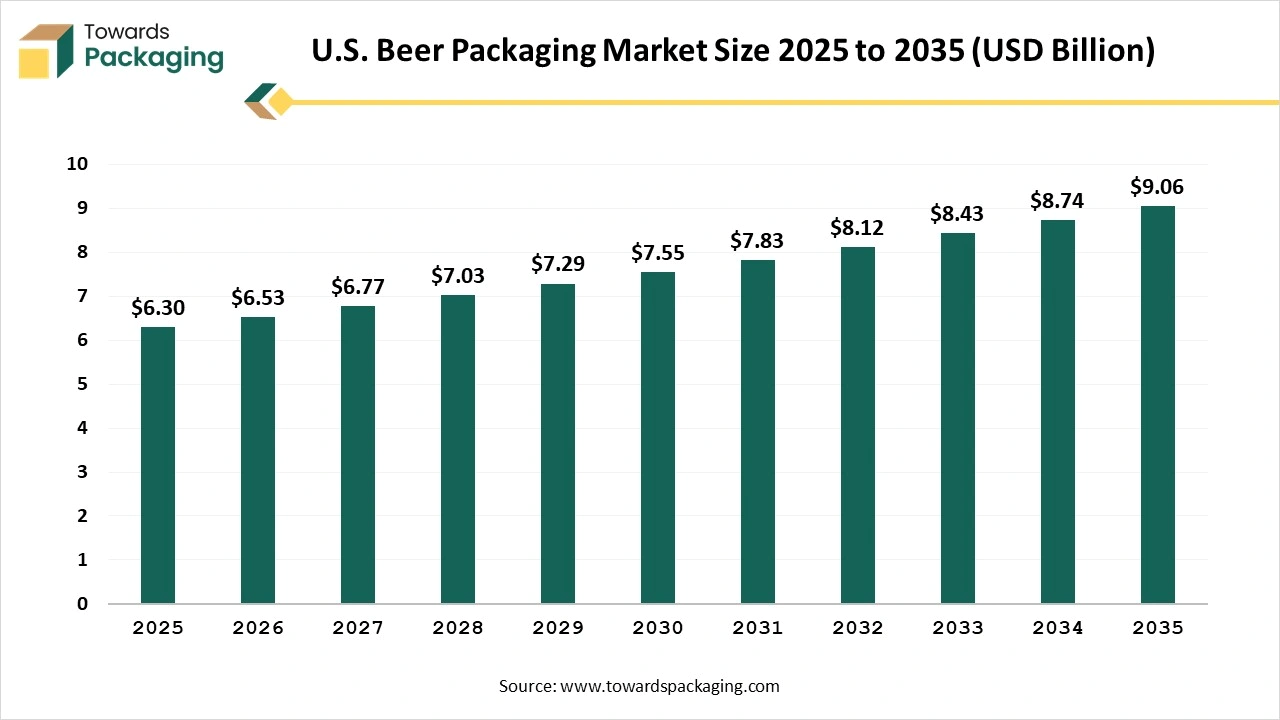

U.S. Beer Packaging Market Projected Growth from USD 6.30 Billion in 2025 to USD 9.06 Billion by 2035

According to Towards Packaging consultants, the global U.S. beer packaging market is projected to reach approximately USD 9.06 billion by 2035, increasing from USD 6.30 billion in 2025, at a CAGR of 3.7% during the forecast period 2026 to 2035.

Ottawa, Feb. 20, 2026 (GLOBE NEWSWIRE) -- The global U.S. beer packaging market stood at USD 6.30 billion in 2025 and is projected to reach USD 9.06 billion by 2035, according to a study published by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by the Beer Packaging?

Beer packaging refers to the science, art, and technology of enclosing beer in containers, primarily glass bottles, aluminum cans, and kegs for protection, storage, transport, and marketing. It fulfils essential functions, including containment, branding, and preservation of quality. It acts as a marketing tool through design, while also ensuring the beer is secure, easy to carry, and properly portioned for the consumer. Modern packaging focuses on recyclable materials, such as aluminum and cardboard.

U.S. Private Industry Investments for Beer Packaging:

- Ardagh Glass Packaging Heritage Expansion: Ardagh expanded its U.S.-made "Heritage" glass bottle collection with shorter, lighter designs intended to improve transport efficiency and reduce carbon footprints.

- Graphic Packaging International Kalamazoo Facility: Graphic Packaging invested over $600 million in a Michigan paperboard facility to produce sustainable, fiber-based multipack carriers for the beverage industry.

- O-I Glass "Fit to Win" Optimization: O-I Glass is executing a $750 million investment initiative to modernize its manufacturing network and improve energy efficiency at U.S. plants producing beer bottles.

- Ball Corporation Aluminum Upgrades: Ball Corporation continues to invest in U.S. facility upgrades to meet the high consumer demand for infinitely recyclable aluminum cans, which currently dominate the beer market.

-

Smurfit Westrock Merger Integration: The $20 billion merger of Smurfit Kappa and Westrock created a massive entity focused on scaling sustainable corrugated and paper packaging solutions for large-scale beer distribution.

What Are the Latest Key Trends in the U.S. Beer Packaging Market?

- Premiumization and Craft Demand: The craft beer segment requires unique, eye-catching, and high-quality packaging to differentiate products on shelves.

- E-commerce and Convenience: The rise in online retail has necessitated more durable packaging that ensures safety during shipping.

-

Sustainability Focus: Manufacturers are shifting toward eco-friendly, recyclable, and lightweight materials to meet consumer demand for environmental responsibility and to reduce transportation costs.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5988

What is the Potential Growth Rate of the U.S. Beer Packaging Industry?

The U.S. beer packaging market is experiencing steady growth, driven by the expansion of craft breweries, premiumization, and a shift toward sustainable, convenient, and single-serve formats. The industry is pivoting toward eco-friendly, recyclable, and biodegradable materials to meet environmental regulations and consumer demand. Increased online retail and at-home consumption have boosted demand for durable, multi-pack, and easy-to-transport packaging solutions.

Segment Outlook

Material Insight

How did Glass Segment Dominate the U.S. Beer Packaging Market?

The glass segment dominated the market in 2025, driven by its reputation for premium quality, superior barrier properties that preserve taste, and 100% recyclability, which fuels the growth of the market. Its dominance is fueled by the growing demand for craft and imported beers, which use glass to enhance shelf appeal, and its ability to withstand pasteurization. Glass is favored for craft and imported beers because it conveys a premium, authentic, and high-quality image to consumers, fueling the growth of the market.

The metal segment is projected to grow at the fastest rate in the market for the forecast period, through superior portability, rapid cooling, 100% light/oxygen protection, and high recyclability, aligning with consumer demand for convenience and sustainability. Aluminum cans have a high recycling rate, and their lightweight nature reduces transport costs and carbon emissions, making them a preferred choice for eco-conscious consumers and brands aiming for sustainability goals supporting the growth of the market.

Product Insight

Which Product Segment Dominates the U.S. Beer Packaging Market?

The bottles segment dominated the market in 2025, particularly for premium, craft, and imported beer categories, where brand image and shelf differentiation are critical. Glass bottles offer strong barrier properties, flavor preservation, and consumer familiarity. Despite competition from cans, bottles continue to hold relevance in restaurants, specialty retail, and multi-pack offerings. Innovations in lightweight glass and sustainability initiatives around recycling further support their continued adoption.

The cans segment is projected to grow at the fastest rate in the market for the forecast period, due to portability, improved recyclability, and superior protection from light and oxygen. Craft brewers increasingly favor cans for distribution efficiency and branding flexibility through advanced printing technologies. The expansion of outdoor consumption, e-commerce alcohol sales, and consumer preference for convenience formats continues to strengthen demand, making cans a dominant choice across mass-market and premium beer categories.

More Insights of Towards Packaging:

- Recyclable Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- U.S. Molded Pulp Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Vaccine Storage Packaging Market Size, Trends and Segments (2026–2035)

- Intelligent Packaging Market Size, Trends and Segments (2026–2035)

- Plastic Packaging Market Size and Segments Outlook (2026–2035)

- Lightweight Industrial Corrugated Packaging Market Size and Segments Outlook (2026–2035)

- Sustainable Aerosol Packaging Market Size, Trends and Segments (2026–2035)

- Poly-Woven Packaging Market Size, Trends and Segments (2026–2035)

- Mono-Material Cosmetic Tubes Market Growth, Trends & Forecast (2025-2035)

- U.S. Beer Packaging Market Size and Trend, Segment Outlook (2026–2035)

- Cold Chain Packaging Refrigerants Market Size, Trends and Segments (2026–2035)

- Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- Heavy-Duty Corrugated Bulk Boxes Market Size and Segments Outlook (2026–2035)

- Next-Gen Paper & Fiber-Based Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Flow Wrap Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- India Molded Pulp Packaging Market Size, Trends and Segments (2026–2035)

- Clear Plastic Film Market Size, Volume, Price and Trends (2026 - 2035)

- Polyethylene Films Market Size, Trends and Volume (2026-2035)

-

Thin Wall Packaging Market Size and Segments Outlook (2026–2035)

End Use Insight

How did the Breweries Segment Dominate the U.S. Beer Packaging Market?

The breweries segment dominated the market in 2025, driven by the presence of large multinational producers as well as a vibrant craft brewing ecosystem. Packaging decisions are influenced by scale, distribution reach, sustainability commitments, and branding strategies. Investments in automated filling lines, variety packs, and innovative container designs help breweries optimize logistics while responding to evolving consumer expectations for quality, freshness, and environmental responsibility, driving growth.

The restaurants and bars segment is projected to grow at the fastest rate in the market for the forecast period, particularly for bottled formats, specialty releases, and premium offerings that enhance on-premise presentation. Kegs remain important, but packaged beer supports menu diversification, easier storage, and reduced wastage. Growth in experiential dining, sports venues, and hospitality expansion continues to stimulate demand for differentiated packaging that aligns with branding, portion control, and customer convenience.

Recent Breakthroughs in the U.S. Beer Packaging Industry

In January 2026, Modelo, the top-selling beer brand in the U.S., introduced its first non-alcoholic beverage in the market, Modelo Chelada Limón y Sal Non-Alcoholic, available nationwide in 12-ounce cans. This new offering coincides with the "mindful drinking" trend and "Dry January" initiative, featuring the zesty flavors of natural lime and salt with less than 0.5% alcohol by volume and 60 calories per can.

In October 2025, DS Smith partnered with Carlsberg Group to introduce a fully recyclable, fiber-based Point-of-Sale display for Kronenbourg 1664 Blanc's German market entry. Constructed from monomaterial corrugated cardboard with offset printing and varnish, the display is modular for retail flexibility and includes internal supports for transport efficiency.

In March 2025, Ball Corporation and LOA introduced the first beer cans in Chile to feature the Aluminium Stewardship Initiative (ASI) seal, indicating the aluminum is sourced through a value chain that adheres to strict environmental, social, and governance standards. This collaboration underscores the increasing demand for sustainable packaging in the South American craft beer industry.

Top Companies in the U.S. Beer Packaging Market & Their Offerings:

- Amcor plc: Supplies rigid PET bottles with barrier technologies and recyclable flexible films.

- ALPLA: Manufactures lightweight PET bottles, preforms, and custom plastic closures.

- Ardagh Group S.A.: Produces a wide range of glass bottles and infinitely recyclable aluminum cans.

- Smurfit Westrock: Provides sustainable paperboard carriers, multipack boxes, and fiber-based can rings.

- Crown: Specializes in aluminum beverage cans and high-performance metal ends and closures.

- Gamer Packaging: Distributes custom glass and plastic bottles alongside crowns and secondary carriers.

- O-I Glass (O-IPS): Manufactures premium glass bottles and growlers with specialized sensory designs.

- Berlin Packaging: Offers a massive catalog of glass and plastic containers, aluminum cans, and caps.

- CCL Industries: Delivers decorative pressure-sensitive labels and shrink sleeves for brand differentiation.

- CANPACK: Produces aluminum cans featuring advanced high-definition printing and decorative effects.

Segment Covered in the Report

By Material

- Glass

- Plastic

- Metal

- Other

By Product

- Bottles

- Cans

- Kegs

- Others

By End-Use

- Breweries

- Restaurants & Bars

- Convenience Stores

- Liquor Stores

- Others

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

North America Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

Europe Transfer Molded Pulp Packaging Market Size, Trends and Regional Analysis (2026–2035)

Europe Food Packaging Market Size and Segments Outlook (2026–2035)

Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

Next-Generation Packaging Market Size, Trends and Competitive Landscape (2026–2035)

Recycled Materials Packaging Solutions Market Size and Segments Outlook (2026–2035)

Commercial Printing Market Size, Trends and Competitive Landscape (2026–2035)

Packaging Films Market Size and Segments Outlook (2026–2035)

Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

South Korea Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

Germany Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

U.S. Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

U.S. Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

U.S. Glass Packaging Market Size and Segments Outlook (2026–2035)

Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44 ; sales@towardspackaging.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.