Recyclable Thermoform Blister Packaging Market Volume and Pricing Data 2026-35

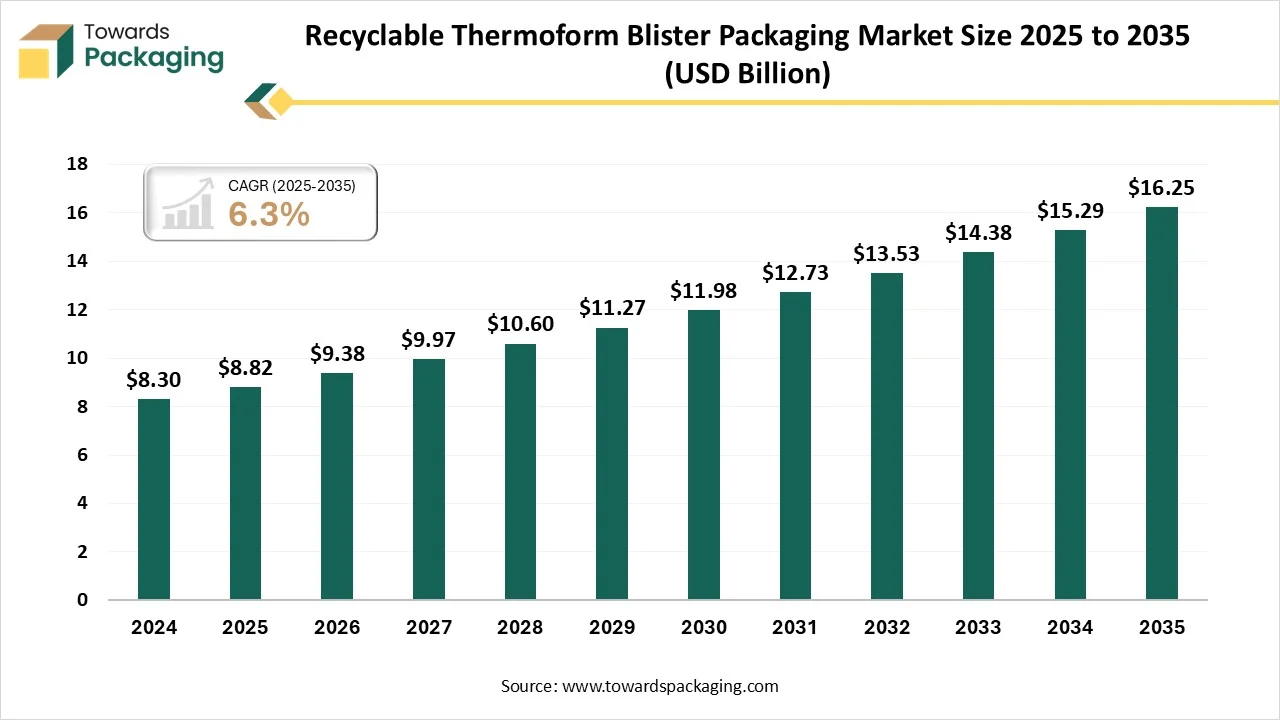

According to researchers from Towards Packaging, the global recyclable thermoform blister packaging market, estimated at USD 8.82 billion in 2025, is forecast to expand to USD 16.25 billion by 2035, growing at a CAGR of 6.3% over the forecast period.

Ottawa, Feb. 16, 2026 (GLOBE NEWSWIRE) -- The global recyclable thermoform blister packaging market hit USD 8.82 billion in 2025, with current forecasts pointing to USD 16.25 billion by 2035, according to Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by the Recyclable Thermofrorm Blister Packaging?

Recyclable thermoform blister packaging refers to sustainable, molded plastic packaging commonly used for pharmaceuticals, designed to be recycled. It typically replaces traditional PVC/aluminum with mono-materials like recyclable polyethylene (PE) or polypropylene (PP). These packs use heat to form cavities while offering reduced carbon footprints and easier recycling streams.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5936

Private Industry Investments for Recyclable Thermoform Blister Packaging:

Amcor's AmSky™ Platform Development: Amcor has invested in the first recycle-ready, polyethylene-based thermoform blister system that eliminates PVC to reduce carbon footprints by up to 70%.

Toppan Holdings' $1.8 Billion Acquisition of Sonoco's TFP Unit: In late 2024, Toppan acquired Sonoco's thermoformed and flexibles business to scale sustainable packaging solutions across the Americas.

Constantia Flexibles' €100 Million Global Facility Upgrade: Constantia has committed over €100 million to upgrade its production network to support their "Designed for Recycling" product portfolio.

Huhtamaki and Syntegon's Paper-Based Blister Collaboration: Huhtamaki partnered with Syntegon to invest in and launch "Push Tab," a plastic-free, FSC-certified paper blister solution for the pharmaceutical industry.

TekniPlex Healthcare's Recycled-Content Film Launch: TekniPlex recently invested in developing and unveiling transparent blister films that incorporate 30% post-consumer recyclate while maintaining critical medical barrier properties.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

What Are the Latest Key Trends in the Recyclable Thermoform Blister Packaging Market?

- Lightweighting and Material Efficiency: Advanced, thinner-walled thermoforming techniques are being used to reduce material usage, thereby lowering costs and environmental impact.

- Smart Packaging Integration: Incorporation of digital watermarking, QR codes, and sensors to improve traceability, which is a growing trend in the market.

-

High Post-Consumer Recycled (PCR) Content: A major focus is on incorporating higher percentages of rPET into thermoformed packaging to support a circular economy.

What is the Potential Growth Rate of The Recyclable Thermoform Blister Packaging Industry?

The global recyclable thermoformed blister industry is projected to grow at a high rate, driven by the urgent demand for sustainable packaging, with companies increasingly adopting biodegradable and fully recyclable materials to meet ESG mandates. The shift is largely driven by environmental regulations and consumer preference for sustainable packaging materials over traditional plastics. Key industries, particularly pharmaceuticals, are adopting these solutions for product protection, tamper evidence, and reduced environmental footprint.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Regional Analysis:

Who is the leader in the Recyclable Thermoform Blister Packaging Market?

Asia Pacific dominated the global market by holding the highest market share in 2025, driven by expanding pharmaceutical manufacturing, rising environmental awareness, and improving recycling infrastructure. Countries across the region are gradually implementing plastic waste regulations, encouraging manufacturers to integrate recycled materials into packaging formats. Growth is also supported by increasing exports of packaged pharmaceuticals and consumer electronics.

China Recyclable Thermoform Blister Packaging Market Trends

China is a major contributor to regional growth as regulatory reforms and sustainability initiatives push packaging manufacturers toward recycled-content solutions. Expansion of domestic recycling capacity and investments in advanced sorting technologies support higher-quality recycled thermoform materials. The country’s large pharmaceutical and electronics manufacturing base creates strong demand for cost-effective and sustainable blister packaging solutions.

North America’s Growing Recyclable Thermoform Blister Packaging Industry

North America is expected to grow at a high rate in the forecast period, driven by strong sustainability regulations, high recycling awareness, and increasing demand from the pharmaceutical, consumer goods, and electronics industries. The region benefits from advanced recycling infrastructure, growing adoption of post-consumer recycled (PCR) plastics, and brand commitments toward circular packaging solutions. Regulatory pressure to reduce virgin plastic usage continues to accelerate the shift toward recycled thermoform blister formats.

US Recyclable Thermoform Blister Packaging Market Trends

The U.S. leads the North American market due to stringent packaging sustainability targets set by pharmaceutical companies and retailers. High consumption of blister packaging in healthcare, combined with FDA-compliant recycled material innovations, supports market growth. Investments in chemical and mechanical recycling technologies further enable higher-quality recycled thermoform materials, increasing adoption across regulated and non-regulated packaging applications.

More Insights of Towards Packaging:

- Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

- Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- South Korea Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Germany Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Flexible Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- France Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Japan Packaging Machinery Market Size, Trends and Competitive Landscape (2026–2035)

- Repackaging Service Market Size and Segments Outlook (2026–2035)

- Corrugated Automotive Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Barrier-Coated Flexible Paper Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Bio-Based Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Active and Intelligent Packaging Market Size and Segments Outlook (2026–2035)

- Plain Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Waste Management Market Size, Trends and Competitive Landscape (2026–2035)

- Track and Trace Packaging Market Size, Trends and Segments (2026–2035)

- Single-Use Plastic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

-

Unbleached Kraft Paperboard Market Size, Trends and Segments (2026–2035)

Segment Outlook

Material Type Insight

The recyclable PET (polyethylene terephthalate) segment dominated the recyclable thermoform blister packaging market in 2025, due to its good clarity, stiffness, and recyclability. It is widely used in blister applications where visual product presentation and basic barrier properties are required. Growing regulatory pressure to reduce virgin plastic use and increasing commitments toward circular economy practices are driving manufacturers to adopt recycled PET in blister trays. Its cost-effectiveness and compatibility with existing thermoforming processes further support its adoption across multiple end-use industries.

The recyclable rPET (recycled PET) segment is projected to grow at the fastest rate in the market for the forecast period, as it offers higher recycled content while maintaining transparency, strength, and processability comparable to virgin PET. Demand for rPET-based thermoform blister packaging is increasing in regulated industries such as pharmaceuticals and consumer electronics, as brand owners aim to meet sustainability targets and comply with recycling mandates while ensuring consistent material quality and supply.

Product Form /Type Insight

The clamshell blister trays segment dominated the recyclable thermoform blister packaging market in 2025, due to their simplicity, cost efficiency, and wide applicability. These trays provide good product protection, visibility, and ease of handling, making them suitable for pharmaceuticals, electronics, and consumer goods. The shift toward recycled materials in clamshell designs is supported by advancements in material processing and thermoforming technologies, enabling manufacturers to maintain structural integrity while increasing recycled content.

The custom complex blister forms segment is projected to grow at the fastest rate in the market for the forecast period, as they are increasingly adopted for products requiring enhanced protection, tamper resistance, or precise product fit. The use of recycled materials in complex blister forms reflects improvements in material consistency and forming capabilities. As brands focus on differentiation and sustainability simultaneously, demand for customized recycled blister solutions continues to grow.

End-Use Industry Insight

The pharmaceuticals & healthcare segment dominated the recyclable thermoform blister packaging market in 2025, driven by growing emphasis on sustainable packaging solutions. Recycled blister packs are increasingly used for secondary and non-critical primary packaging, supported by improved material traceability and regulatory acceptance. Rising medication consumption, aging populations, and sustainability commitments from pharmaceutical companies are collectively driving demand for recycled thermoformed blister trays in this sector.

The electronics & consumer goods segment is projected to grow at the fastest rate in the market for the forecast period, as manufacturers are rapidly adopting recycled thermoform blister packaging to reduce environmental impact while maintaining product visibility and protection. The push for eco-friendly packaging, combined with consumer awareness and retailer sustainability requirements, is accelerating the shift toward recycled PET and rPET blister solutions across consumer-focused product categories.

Recent Breakthroughs in the Recyclable Thermoform Blister Packaging Industry

In November 2025, National Pharmacies, in partnership with Opticycle, launched a six-month contact lens recycling trial in South Australia in November 2025, aiming to divert 230,000 blister cases from landfill across ten locations. This initiative addresses "forgotten waste" in the eye care sector

In October 2024, Bayer launched a first-of-its-kind PET blister pack for its Aleve brand in the Netherlands, with its partner Liveo Research. This mono-material PET solution is designed for the RIC #1 recycling stream and eliminates PVC.

Top Companies in the Recyclable Thermoform Blister Packaging Market & Their Offerings:

- Bayer: Launched an all-PET blister for its Aleve brand in the Netherlands, a mono-material solution designed specifically for the RIC #1 recycling stream.

- Amcor: Offers the AmSky Blister System, a PVC-free and aluminum-free solution made from polyethylene (PE) that is compatible with existing plastic recycling streams.

- Huhtamaki: Developed the Push Tab series, which includes a mono-material PET blister lid and a sustainable paper-based blister solution made from FSC-certified fibers.

- Klöckner Pentaplast: Provides the kpNext line, featuring PET-based films designed to be processed and recycled in the same stream as plastic water bottles.

- Südpack: Offers a high-barrier Pharma PE Blister solution that utilizes a mono-material polyethylene film to ensure recyclability while maintaining critical shelf-life protection.

- Constantia Flexibles: Developed mono-polymer structures under their EcoLam line that provide the necessary barrier properties for medication while remaining fully recyclable.

Segment Covered in the Report

By Material Type

- Recyclable PET (Polyethylene Terephthalate)

- Mono-material PET thermoforms

- High-clarity PET blister sheets

- Lightweight PET blister films

- Recyclable rPET (Recycled PET)

- Post-consumer recycled (PCR) rPET

- High-PCR content thermoform sheets

- Food-grade rPET blisters

- Recyclable PP (Polypropylene)

- Mono-PP blister trays

- High-heat resistance PP blisters

- Microwave-safe PP thermoforms

- Recyclable PE (Polyethylene)

- HDPE thermoform blisters

- LDPE flexible thermoforms

- PE mono-material blister packs

- PLA / Bio-based Thermoform Materials

- PLA blister trays

- Compostable bio-based thermoforms

- PLA blend thermoform sheets

By Product Form / Type

- Clamshell Blister Trays

- Hinged clamshell blisters

- Snap-lock clamshell trays

- Skin Pack Blisters

- Vacuum skin blisters

- Card-backed skin packs

- Tray & Blister Combinations

- Tray with lidding blister

- Hybrid tray–blister packs

- Blister Cards

- Paperboard-backed blister cards

- Fully recyclable blister cards

- Custom Complex Blister Forms

- Multi-cavity blisters

- Custom-molded structural blisters

By End-Use Industry

- Pharmaceuticals & Healthcare

- Tablet & capsule packaging

- Medical device blisters

- OTC product blisters

- Electronics & Consumer Goods

- Accessories packaging

- Small electronic components

- Food & Beverage

- Fresh produce trays

- Ready-to-eat food blisters

- Personal Care & Cosmetics

- Cosmetic kits & tools

- Personal grooming products

- Industrial & Hardware Products

- Fasteners & tools

- Spare parts packaging

- Toys & Specialty Goods

- Toy accessories

- Hobby & collectible packaging

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5936

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Middle East Packaging Machinery Market Size, Trends and Segments (2026–2035)

- Biofoam Packaging Market Size and Segments Outlook (2026–2035)

- Sanitary Food and Beverage Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ready-to-Use Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Size, Trends and Competitive Landscape (2026–2035)

- Asia Pacific Food Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Europe Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- North America Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- North America Post-Consumer Recycled Plastics Food Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Transfer Molded Pulp Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Food Packaging Market Size and Segments Outlook (2026–2035)

- Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

- North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

- Next-Generation Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Recycled Materials Packaging Solutions Market Size and Segments Outlook (2026–2035)

- Commercial Printing Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Films Market Size and Segments Outlook (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.