Gastrointestinal Stent Market Report: Size, Share, Growth, Trends and Forecast to 2034

Key companies covered in the Gastrointestinal Stent Market are Boston Scientific Corporation, Olympus Corporation, Medtronic, and CONMED Corporation.

The global gastrointestinal stent market size was valued at USD 615.8 million in 2025. The market is projected to grow from USD 647.8 million in 2025 to USD 980.6 million by 2034.”

PUNE, MAHARASHTRA, INDIA, February 10, 2026 /EINPresswire.com/ -- The Gastrointestinal Stent Market Size signals robust expansion in a segment of medical devices that addresses blockages and strictures within the digestive tract using minimally invasive methods. According to the latest report by Fortune Business Insights, the global gastrointestinal stent market size was valued at USD 615.8 million in 2025 and is projected to grow from USD 647.8 million in 2025 to USD 980.6 million by 2034, exhibiting a Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period.— Fortune Business Insights

Gastrointestinal stents are flexible tubes typically constructed from metal, plastic, or biodegradable materials that are inserted into regions such as the bile duct, esophagus, stomach, or colon to maintain patency and relieve obstructions caused by various gastrointestinal disorders. These devices are critical tools in the management of conditions such as biliary disease, esophageal cancer, colorectal issues, and inflammatory bowel diseases, and their adoption reflects a broader shift toward minimally invasive interventions that improve clinical outcomes while mitigating surgical risks.

Market Trends

Understanding Key Market Trends reveals how innovation and clinical practices are reshaping the gastrointestinal stent landscape. One emerging trend identified in the report is the increasing endorsement of rigorous clinical guidelines for stent deployment. These guidelines standardize practices for placing stents in cases such as malignant obstructions and colonic strictures, enhancing consistency in treatment, reducing care variability, and improving patient outcomes.

The segmentation of the market also demonstrates that biliary stents hold the largest share of the gastrointestinal stent market, driven by the high volume of bilirubin and bile duct obstruction procedures globally. As manufacturers focus on expanding their portfolios with specialized biliary stenting solutions, the competitive dynamics within this segment continue to intensify.

Another critical trend is the ongoing innovation in stent materials. Metal stents — particularly self-expanding metal stents (SEMS) — dominated the material segment because of their durability and efficacy in maintaining long-term patency and reducing occlusion risks. However, innovations in plastic and biodegradable stents are also gaining attention, especially for temporary applications and cases where removal or resorption is clinically preferred, presenting new avenues for product differentiation.

Get a Free Sample of this Report:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/gastrointestinal-stent-market-114932

Top Companies in Market

• Medtronic (Ireland)

• Boston Scientific Corporation (U.S.)

• CONMED Corporation (U.S.)

• Cook (U.S.)

• Cardinal Health (U.S.)

• ELLA – CS, s.r.o. (U.S.)

• W. L. Gore & Associates, Inc. (U.S.)

• Merit Medical Systems (U.S.)

• HOBBS MEDICAL INC. (U.S.)

• Olympus Corporation (Japan)

Market Segmentation Analysis

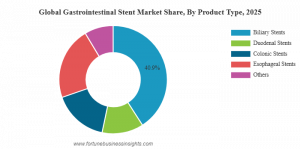

• By Product Type: The market includes biliary stents, duodenal stents, colonic stents, esophageal stents, and others. Biliary stents accounted for the largest share in 2025, mainly attributed to their wide use in bile duct cancer and related disorders requiring stenting. Colonic stents are also projected to grow, reflecting increasing awareness and clinician preference for managing colorectal obstructions through stenting techniques.

• By Material: The gastrointestinal stent market is segmented into metal, plastic, and other materials. In 2025, the metal segment held a dominant share due to its larger diameter and superior patency, making it a preferred choice in clinical scenarios such as malignant obstructions. Plastic stents, however, are expected to grow over the forecast period, driven by their cost-effectiveness and evolving material innovations.

• By Application: The applications covered include biliary disease, colorectal cancer, inflammatory bowel disease, esophageal cancer, gastric/duodenal cancer, and others. Biliary disease represented the largest share due to the high prevalence of strictures and gallstone-related complications, which necessitate frequent stenting procedures. Moreover, esophageal cancer procedures are growing at a notable rate, reflecting both growth in incidence and advances in stent design for oncologic indications.

• By End-User: Hospitals & ASCs (Ambulatory Surgical Centers), clinics, and others form the primary end-user segments. In 2025, hospitals and ASCs dominated the market with the highest share because they accommodate the volume of complex endoscopic procedures and possess the advanced infrastructure required to support stent deployment. Clinics are projected to grow steadily as minimally invasive practices become more distributed across outpatient settings.

Ask for Customization:

https://www.fortunebusinessinsights.com/enquiry/customization/gastrointestinal-stent-market-114932

Regional Insights

REGIONAL INSIGHTS highlight geographic dynamics and growth pockets within the global gastrointestinal stent market:

North America held the dominant position with a valuation of USD 257.9 million in 2025. Robust reimbursement structures, highly developed healthcare infrastructure, and widespread adoption of advanced endoscopic procedures contribute to the region’s leading position. Specifically, the United States continues to drive regional growth given strong procedural volumes and comprehensive healthcare policies supporting stent use.

Europe is expected to experience notable growth, projected to expand at a healthy pace due to increased demand for minimally invasive treatments and strong adoption of advanced stenting solutions. Countries such as Germany, the U.K., and France are anticipated to be key contributors to the region’s market share.

Asia Pacific is also poised for significant expansion in the gastrointestinal stent market, with the region’s healthcare sectors in China, India, and other emerging economies investing in endoscopic technologies and expanding access to advanced procedures. This growth is supported by rising prevalence of GI disorders and improving healthcare infrastructure.

Latin America and the Middle East & Africa are projected to show modest growth, driven by incremental improvements in healthcare access, awareness of minimally invasive treatment benefits, and gradual expansion of gastroenterological services.

Key Industry Developments

• July 2024: CGBIO announced that its biliary stent ARISTENT received approval from Japan’s Pharmaceuticals and Medical Devices Agency (PMDA), thereby accelerating its entry into the Japan market.

• January 2024: Olympus Corporation acquired Taewoong Medical, a South Korean manufacturer of gastrointestinal metallic stents, to enhance Olympus's GI EndoTherapy portfolio and strengthen its global presence in GI treatment solutions.

Read Related Reports:

Intragastric Balloon Market Size, Share

Laparoscopic Surgical Procedures Market Size

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.