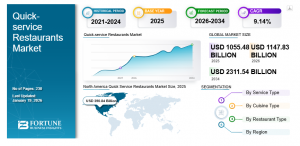

Quick Service Restaurants Market Size to Reach USD 2,311.54 Billion by 2034 | CAGR – 9.14% (2026–2034)

Quick Service Restaurants Market Size to Reach USD 2,311.54 Billion by 2034, Supported by Delivery Innovation and Global Franchise Expansion

North America dominated the quick-service restaurants market with a market share of 37.03% in 2025.”

NY, UNITED STATES, February 10, 2026 /EINPresswire.com/ -- The global quick service restaurants market size was valued at USD 1,055.48 billion in 2025 and is projected to grow from USD 1,147.83 billion in 2026 to USD 2,311.54 billion by 2034, exhibiting a CAGR of 9.14% during the forecast period. North America dominated the quick service restaurants market with a 37.03% share in 2025, supported by a strong franchise ecosystem, high number of working households, and widespread adoption of digital ordering platforms.— Fortune Business Insights

The U.S. quick service restaurant market is projected to grow significantly, reaching USD 599.87 billion by 2032, driven by strong consumer inclination toward quick dining, loyalty programs, and technology-enabled services.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/quick-service-restaurants-market-103236

Quick Service Restaurants Market Takeaways

The market is experiencing accelerated growth due to rising demand for convenient dining options, expansion of digital food delivery platforms, and rapid penetration of QSR chains in developing economies. Delivery services are expected to register the highest CAGR, while chained restaurants continue to lead revenue generation.

COVID-19 Impact

Restrictions on Dine-In Services Temporarily Disrupted Market Growth

The COVID-19 pandemic significantly impacted the global QSR market as restrictions on dine-in services led to partial or complete closure of restaurant outlets worldwide. Consumer footfall and spending on dine-in services declined sharply due to health concerns and lockdown measures. However, the crisis accelerated the adoption of digital ordering, contactless delivery, and takeaway services, supporting gradual market recovery post-pandemic.

Quick Service Restaurants Market Trends

Rising Demand for Vegan and Plant-Based Fast Food Supports Market Growth

The global shift toward vegan and flexitarian diets is creating new growth avenues for the QSR market. According to Our World in Data, the vegan population increased from 2% in 2019 to 5% in January 2023. Health consciousness and demand for plant-based alternatives have encouraged QSRs to introduce vegan burgers, sandwiches, and bread options.

Plant-based startups in Europe and established QSR brands are actively launching vegan offerings to attract a wider consumer base, creating long-term opportunities for market expansion.

Market Growth Factors

Growing International Tourism to Supplement QSR Market Growth

The rebound of the global tourism industry has significantly supported QSR demand. According to the UNWTO World Tourism Barometer 2022, over 900 million international tourists traveled globally in 2022, reaching 63% of pre-pandemic levels. Europe recorded nearly 550 million tourist arrivals, close to 80% of 2019 levels, while the Middle East showed the fastest recovery.

Rising tourist footfall increases demand for quick, accessible food options, encouraging QSR operators to expand outlets in tourist destinations, airports, and cultural sites.

Increased Spending on Dining Out to Drive Market Expansion

Rising household incomes, growing dual-income families, and increasing participation of working women are driving higher spending on dining out. Millennials, in particular, show a strong preference for QSRs over traditional dining formats, encouraging rapid franchise expansion and revenue growth.

Restraining Factors

Rising Popularity of Cloud Kitchens to Limit Market Growth

The growing adoption of cloud kitchens presents a restraint for traditional QSR outlets. Cloud kitchens operate with lower capital investment and minimal overhead costs, making them highly competitive. Government support and investment inflows into the cloud kitchen ecosystem are expected to increase competition and limit physical QSR outlet expansion.

Quick Service Restaurants Market Segmentation Analysis

By Service Type

The market is segmented into dine-in, takeaway, and delivery.

The dine-in segment is projected to hold a 52.91% share in 2026, supported by consumers seeking complete dining experiences. However, the delivery segment is expected to record the highest CAGR, driven by smartphone penetration, app-based ordering, and digital payment solutions.

By Cuisine Type

American cuisine dominates the market, accounting for a 59.86% share in 2026, driven by the global presence of burger and pizza chains such as McDonald’s Corporation and Burger King. Rapid expansion into emerging markets continues to support this segment’s dominance.

By Restaurant Type

Independent QSRs account for a 59.13% share in 2026, especially in developing economies. However, chained restaurants are projected to grow at the fastest pace due to aggressive global expansion strategies by major franchise operators.

Regional Insights

North America

North America dominated the market with a size of USD 390.84 billion in 2025, increasing to USD 422.65 billion in 2026. The U.S. remains the largest market and is projected to reach USD 343.09 billion by 2026, supported by loyalty programs, digital engagement, and consolidation activities.

Asia Pacific

Asia Pacific is expected to emerge as the fastest-growing region, driven by strong population growth, urbanization, and millennial preference for QSR dining. Japan, China, and India are projected to reach USD 57.35 billion, USD 186.74 billion, and USD 27.62 billion by 2026, respectively.

Europe

Europe continues to witness strong QSR demand due to rising tourism, dine-in culture, and demand for convenient food options. The UK and Germany markets are projected to reach USD 17.53 billion and USD 30.61 billion by 2026, respectively.

South America & Middle East & Africa

South America is experiencing steady growth due to strong dining culture and affordability, while the Middle East & Africa region is projected to record high CAGR supported by tourism growth, food imports, and expanding e-commerce food platforms.

Have Any query? Ask Our Experts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/quick-service-restaurants-market-103236

Key Industry Players

Product Innovation and Franchise Expansion Remain Key Competitive Strategies

Leading QSR brands are focusing on menu innovation, vegan offerings, and digital transformation to retain market competitiveness.

List of Top Quick Service Restaurants Companies:

Chick-fil-A

Papa John’s International

Subway

Starbucks Corporation

Yum! Brands

McDonald’s Corporation

Restaurant Brands International

The Wendy’s Company

Dunkin

Domino’s Pizza

Key Industry Developments

August 2023: Subway agreed to sell its business to affiliates of Roark Capital.

October 2023: Domino’s U.S. launched the Free Emergency Pizza program.

December 2023: McDonald’s announced its new café-focused concept, CosMc’s.

March 2023: Starbucks announced plans to open 100 new stores in the U.K.

June 2023: Pizza Hut launched its single-serving “Pizza Hut Melts”.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.