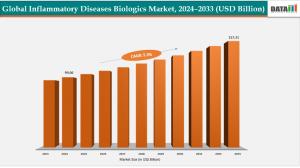

Inflammatory Diseases Biologics Market to Hit $157.31B by 2033 at 5.3% CAGR | North America Leads with 48.5%

Inflammatory Biologics Market Forecast at $157.31B by 2033 | CAGR 5.3% | Major Players: Eli Lilly, Takeda, AbbVie, Pfizer

The inflammatory diseases biologics market is expanding as demand grows for targeted, effective therapies that offer improved treatment outcomes over traditional medications”

LEANDER, TX, UNITED STATES, December 4, 2025 /EINPresswire.com/ -- According to DataM Intelligence, the Global Inflammatory Diseases Biologics Market was valued at US$ 99.06 billion in 2024 and is projected to reach US$ 157.31 billion by 2033, expanding at a CAGR of 5.3% during the forecast period 2025–2033. Market growth is driven by rising demand for anti-inflammatory biologics that offer higher efficacy, targeted mechanisms of action, and better long-term disease control compared to conventional therapies. The increasing prevalence of autoimmune disorders such as Crohn’s disease, psoriasis, ulcerative colitis, and rheumatoid arthritis continues to propel the adoption of biologic therapies worldwide.— DataM Intelligence

Biologics are gaining strong preference among patients and clinicians due to reduced relapse rates, improved symptom control, and the availability of advanced long-acting formulations. Continuous biopharmaceutical innovation, coupled with significant R&D investments, is leading to the development of next-generation biologics and biosimilars with enhanced safety and effectiveness. As healthcare systems increasingly prioritize targeted therapies and precision medicine, biologics are expected to remain at the forefront of inflammatory disease treatment globally.

Download your exclusive sample report today: (corporate email gets priority access): https://www.datamintelligence.com/download-sample/inflammatory-diseases-biologics-market

Key Highlights from the Report:

The market is growing steadily due to rising demand for biologic therapies targeting autoimmune and inflammatory conditions.

Anti-TNF inhibitors represent the largest drug class segment, supported by their proven effectiveness across multiple inflammatory diseases.

Rheumatoid arthritis is the leading indication, accounting for the highest demand for biologic treatments.

North America holds the largest market share, while Asia-Pacific is the fastest-growing region driven by increasing disease prevalence and improving access to advanced biologics.

Market growth is further supported by ongoing innovation, expanding therapeutic indications, and the rising adoption of biosimilars.

Key Segments

By Drug Class

Anti–Tumor Necrosis Factor (TNF) inhibitors hold the largest share as they remain the most widely prescribed biologics for autoimmune and inflammatory disorders, offering proven long-term efficacy and broad clinical adoption. Interleukin antagonists are growing rapidly due to their targeted mechanism of action, improved safety profiles, and expanding approvals across conditions such as psoriasis, rheumatoid arthritis, and IBD. Janus Kinase (JAK) inhibitors show strong growth momentum as orally administered small-molecule therapies that provide convenient dosing, rapid symptom relief, and expanding use in patients who do not respond to biologics. Other drug classes, including corticosteroids, DMARDs, and next-generation biologics, support treatment diversification across complex immune-mediated diseases.

By Disease Indication

Rheumatoid arthritis dominates the market as it has a high global prevalence and strong demand for advanced biologics, targeted therapies, and long-term disease management solutions. Psoriasis represents a rapidly expanding segment driven by the effectiveness of newer biologics and rising diagnosis rates worldwide. Inflammatory bowel disease (IBD), including Crohn’s disease and ulcerative colitis, continues to grow as precision therapies and biologics improve outcomes for chronic gastrointestinal inflammation. Ankylosing spondylitis shows steady adoption of biologics and targeted therapies as awareness and diagnostic capabilities improve. Other indications, such as uveitis, juvenile idiopathic arthritis, and systemic lupus, further contribute to market expansion as research advances and treatment pipelines broaden.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=inflammatory-diseases-biologics-market

Key Players

Amgen | AbbVie | Pfizer | Novartis | Johnson & Johnson | Roche | GSK | Sanofi | Eli Lilly | Takeda

Key Highlights

Amgen – Holds an estimated 12.4% share, driven by its strong immunology portfolio, leadership in biologics, and expansion of next-generation IL-targeting therapies and biosimilars.

AbbVie – Accounts for around 15.8% share, supported by its dominant TNF inhibitor portfolio, expanding IL-23 and JAK inhibitor pipeline, and long-standing leadership in autoimmune disease treatments.

Pfizer – Maintains approximately 10.6% share, propelled by its diversified immunology assets, next-gen anti-inflammatory biologics, and strategic investments in autoimmune research.

Novartis – Represents nearly 11.9% share, backed by its advanced IL-17 and IL-23 inhibitors, strong global market presence, and consistent innovation in inflammatory disease therapeutics.

Johnson & Johnson – Holds about 13.7% share, driven by its leading monoclonal antibody therapies, robust late-stage pipeline, and expanding focus on chronic immune-mediated disorders.

Roche – Accounts for around 9.8% share, supported by its precision immunology research, novel biologics targeting inflammatory pathways, and sustained advancements in autoimmune treatment.

GSK – Maintains approximately 7.4% share, recognized for its emerging biologics portfolio, IL-targeted therapies, and strategic focus on chronic inflammatory and immune dysfunction disorders.

Sanofi – Represents about 8.2% share, backed by its strong dermatology-focused biologics leadership, expanding IL and TNF inhibitor assets, and growing biosimilar capabilities.

Eli Lilly – Holds nearly 5.7% share, driven by its innovative autoimmune therapy pipeline, next-generation cytokine inhibitors, and expanding portfolio across inflammatory diseases.

Takeda – Accounts for around 4.5% share, supported by its niche autoimmune therapies, biologics expansion strategy, and growing development of targeted immune-modulating agents.

Regional Insights

• North America – 48.5% driven by "high prevalence of autoimmune and chronic inflammatory disorders, strong biologics R&D ecosystem, favourable reimbursement policies, and rapid adoption of next-generation biologics and biosimilars."

• Europe – 34.5% supported by "well-established public healthcare systems, widespread availability of biologic therapies, high diagnosis rates of inflammatory diseases, and strong uptake of both branded biologics and biosimilars."

• Asia-Pacific – 12% fueled by "rising incidence of inflammatory and autoimmune conditions, expanding healthcare access, improving biologics distribution networks, and growing patient awareness of advanced immunotherapies."

• Latin America – 3% driven by "increasing access to specialty treatments, gradual availability of biosimilars, and growing demand for cost-effective biologic options for chronic inflammatory diseases."

• Middle East & Africa – 2% supported by "expanding medical infrastructure, improving access to biologic therapies, rising disease awareness, and early-stage adoption of biosimilar immunotherapies."

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/inflammatory-diseases-biologics-market

Key Developments

September 2025: A new ustekinumab biosimilar received positive regulatory endorsement in Europe, expanding treatment options for inflammatory conditions such as psoriasis, psoriatic arthritis, Crohn’s disease, and ulcerative colitis.

August 2025: Multiple biosimilar biologics entered global markets, increasing access to cost-effective therapies for chronic inflammatory diseases and strengthening competition in the biologics landscape.

June 2025: A newly launched ustekinumab biosimilar in the U.S. expanded biologic availability for autoimmune and inflammatory diseases including Crohn’s disease, ulcerative colitis, plaque psoriasis, and psoriatic arthritis.

March 2025: An interchangeable omalizumab biosimilar received regulatory approval, marking a key milestone in improving affordability and accessibility for patients with asthma, chronic rhinosinusitis with nasal polyps, chronic urticaria, and other inflammatory conditions.

Frequently Asked Questions (FAQs):

How big is the global inflammatory diseases biologics market in terms of growth forecast?

The global inflammatory diseases biologics market was valued at US$ 99.06 billion in 2024, with steady growth expected through 2033.

What is the projected CAGR for the inflammatory diseases biologics market?

The market is projected to grow at a CAGR of 5.3% during 2025–2033.

What is the expected market size by 2033?

By 2033, the market is expected to reach approximately US$ 157.31 billion.

Which drug-class segment leads the inflammatory diseases biologics market?

The Anti-TNF (Tumor Necrosis Factor) inhibitors segment leads the market, holding about 44.3% share in 2024.

Which indication segment dominates the inflammatory diseases biologics market?

Rheumatoid Arthritis (RA) is the leading indication, accounting for about 40.3% of the market share in 2024.

Conclusion:

The global biologics market for inflammatory diseases is growing steadily, driven by the rising prevalence of autoimmune and chronic inflammatory conditions and the increasing demand for targeted, effective therapies. Biologics are becoming the preferred treatment option because they offer higher efficacy, more precise mechanisms of action, and better long-term management for conditions such as rheumatoid arthritis, psoriasis, inflammatory bowel disease, and ankylosing spondylitis.

Although high treatment costs, side-effect risks, and complex manufacturing requirements continue to pose challenges, ongoing advancements in biologic therapies, expanding indications, and the introduction of more affordable biosimilars are strengthening market adoption. As innovation continues and access improves, biologics are expected to play an even more essential role in managing inflammatory diseases and improving patient outcomes worldwide.

Related Reports:

1. Rheumatoid arthritis drugs market

2. Inflammatory bowel disease market

Sai Kiran

DataM Intelligence 4market Research LLP

+ +1 877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.