Canned Tuna Market Size, Trends, Key Manufacturers, and Import/Export Data to 2034

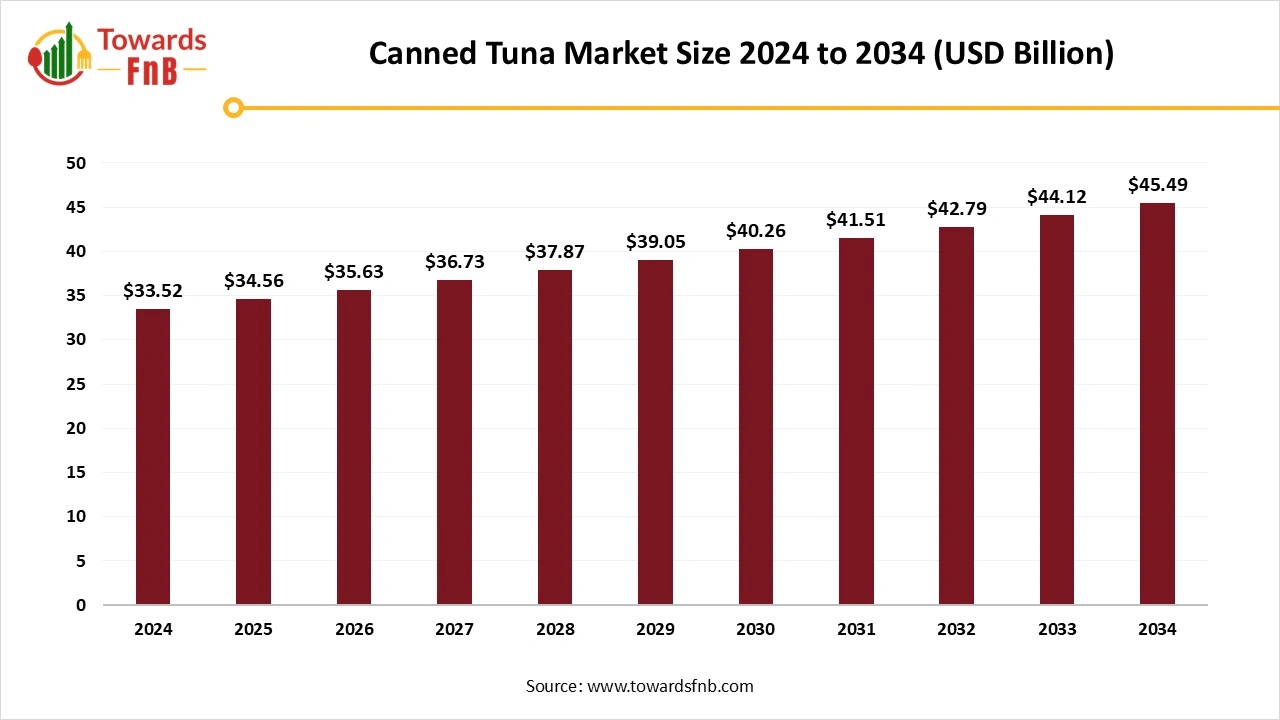

According to Towards FnB, the global canned tuna market size is evaluated at USD 34.56 billion in 2025 and is expected to hit USD 45.49 billion by 2034, reflecting at a CAGR of 3.1% from 2025 to 2034. This growth underscores the rising global demand for quick, nutritious food options that offer both convenience and sustainability.

Ottawa, Nov. 24, 2025 (GLOBE NEWSWIRE) -- The global canned tuna market size stood at USD 33.52 billion in 2024 and is predicted to increase from USD 34.56 billion in 2025 to reach around USD 45.49 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to experience a boom in the period ahead due to various factors such as high demand for convenience, easy-to-prepare, and high-protein seafood options. Such seafood options are highly opted for by health-conscious consumers who ensure to maintain their nutritional profile under any circumstances.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5923

Key Highlights of the Canned Tuna Market

- By region, Europe led the canned tuna market in 2024, whereas the Middle East and Africa are expected to grow in the foreseeable period.

- By species type, the skipjack segment led the canned tuna market in 2024, whereas the yellowfin segment is expected to grow in the foreseeable period.

- By product style, the light tuna segment captured the maximum share in 2024, whereas the Albacore tuna segment is expected to grow in the foreseeable period.

- By packaging format, the metal cans segment led the canned tuna market in 2024, whereas the pouches segment is expected to grow in the foreseeable period.

- By distribution channel, the supermarkets and hypermarkets segment dominated the canned tuna industry in 2024, whereas the online segment is expected to grow in the foreseen period.

Nutritional Benefits are helpful for the Growth of the Canned Tuna Industry

The canned tuna market is expected to grow significantly due to higher demand for convenient, protein-rich, and long-lasting food options. Such options allow consumers to maintain their nutritional profile and avoid munching on unhealthy options. Canned tuna has a longer shelf life and retains its nutritional properties. Such factors help to fuel the growth of the canned tuna market. Tuna is rich in protein, omega-3 fatty acids, vitamins, and minerals, and is therefore preferred by consumers globally.

Sustainability is helpful for the Growth of the Canned Tuna Sector

Consumer awareness regarding the disadvantages of overfishing, unsustainable fishing methods, and bycatch has compelled the sector to adopt environmentally friendly practices. Hence, canned tuna brands ensure they follow methods with a lower environmental impact, such as using selective fishing gear, sourcing tuna from well-managed fisheries, and other similar practices. Hence, such factors are helping drive market growth and educating consumers about the benefits of sustainable practices.

New Trends of the Canned Tuna Market

- Higher demand for innovative products such as herb-infused, spiced, and flavorful canned tuna is a major factor driving market growth.

- Higher demand for convenient packaging options, such as pouches, tetra packs, and similar forms for easy handling, is another major factor driving market growth.

- Higher demand for sustainably sourced canned tuna also helps to fuel the growth of the market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/canned-tuna-market

Impact of AI on the Canned Tune Market

Artificial intelligence (AI) is transforming the canned tuna market by improving transparency in sourcing, manufacturing efficiency, and product quality. In the sourcing stage, AI-powered satellite monitoring and machine learning models track fishing vessel activity, helping companies verify legal and sustainable catch practices. These systems also support traceability by linking catch data to processing batches, ensuring compliance with sustainability requirements and helping brands address concerns about overfishing and unethical practices.

AI-driven computer vision systems sort, clean, and inspect tuna with high precision. These tools detect defects, foreign materials, and inconsistencies in color or texture, thereby improving food safety and reducing waste. Predictive analytics monitors machinery performance, forecasts maintenance needs, and optimizes energy use, enabling producers to run more efficiently with fewer interruptions.

Recent Developments in the Canned Tuna Market

- In August 2025, Bumble Bee Seafoods introduced its new product line, Bumble Bee Snackers. The new line includes single-serve cans of flavored and unflavored tuna. The flavored tuna cans involve interesting flavor options such as lemon pepper, hickory smoke, sweet heat, Thai chilli, tuna salad, and plain chunk light tuna.

- In January 2025, Major US grocery chains had introduced multiple discounts and promotions on seafood options at the beginning of 2025 as part of their ‘Resolution Reset Week’. The discount allowed the loyalty members to get a free can of tuna or sardines from USA-based Natural Grocers with any purchase of the brand’s product.

Trade Analysis of the Canned Tuna Market

Import & Export Statistics

Global Trade Scale and Recent Trend Signals

International tuna trade declined in 2023 in both volume and value compared with 2022, with trade falling to roughly 3.39 million tonnes and about USD 15 billion, driven by weaker raw material supply and lower consumer demand for some product forms. Globefish (FAO) reports that canned tuna remains the largest segment within the processed fish trade under HS 1604, accounting for about 43 percent of volumes in 2023.

Leading Exporters (Value and Volume)

Thailand is the world’s largest canned tuna exporter by value and volume, with exports of about USD 2.09 billion and roughly 445,000 tonnes reported in 2023. Ecuador is the second-largest exporter, at about USD 1.19 billion, followed by China (approx. USD 0.83 billion) and Spain (approx. USD 0.79 billion). These five exporters together account for the majority of global canned tuna shipments.

Major Importers and Demand Hubs

Import demand is concentrated in high-consumption markets and major processing hubs. Japan, the United States, South Korea, and EU markets are among the largest importers for canned and processed tuna products; Japan and the United States register large annual import values and frequent shipments for retail cans and industrial use. Tridge and shipment trackers list Japan as the top importer by value in 2023, followed by the United States and South Korea.

Product Forms, Pricing, and Logistics That Shape Trade

Canned tuna trade includes retail-packed cans, pouches, bulk cans for industrial use, cooked loins and minced tuna for further processing. Price signals are sensitive to the species mix (skipjack versus yellowfin), raw material availability and canning yields. Freight and cold-chain logistics mainly affect shipments of precooked loins and chilled products, while shelf-stable cans travel in standard containerised cargo. InfoFish and Globefish notes show that lower catches and higher raw-material prices in some seasons tightened supply and pushed trade volatility in 2023–2024.

Recent Dynamics and Drivers (2023–2024)

- Reduced catches for key tuna species and higher competition for raw skipjack drove down trade volumes in 2023, then a partial recovery was recorded in early 2024 as canneries rebuilt inventories.

- Shifts in consumer demand toward ready-to-eat and pouch formats supported imports of certain higher-value processed lines in 2024.

Trade Risks, Regulation, and Sustainability Considerations

Market access and trade flows are affected by sanitary controls, traceability requirements, and demand for sustainability certifications, such as the MSC chain-of-custody. Buyers increasingly prefer suppliers who can demonstrate sustainable sourcing and full traceability, which can influence supplier selection in higher-value markets. National fishery policies and export taxes or bans in some producing countries may also alter short-term export availability.

Product Survey of the Canned Tuna Market

| Product Category | Description / Function | Common Forms / Variants | Key Applications / End Use Segments | Representative Brands / Producers |

| Canned Tuna in Oil | Tuna packed in vegetable oil for richer flavor and higher moisture retention. | Sunflower oil, olive oil, soybean oil blends | Retail cans, salads, sandwiches, and ready meals | Bumble Bee Foods, StarKist, Thai Union (SeaChange), Rio Mare |

| Canned Tuna in Water | Tuna packed in water for a lighter taste and lower calorie content. | Light tuna in water, white albacore in water | Healthy meals, weight management, and general retail | Chicken of the Sea, Genova, Bolton Group |

| Solid Pack Tuna | Whole, firm chunks of tuna are packed tightly for premium product quality. | Solid white albacore, solid skipjack | Premium retail, gourmet cooking | Wild Planet Foods, Rio Mare, American Tuna |

| Chunk Light Tuna | Smaller tuna pieces, in water or oil, offer affordability and versatility. | Skipjack, yellowfin blends | Mass retail, family meals, casseroles | StarKist, Great Value, Thai Union Group |

| Flavored or Seasoned Canned Tuna | Pre-seasoned tuna is ready for direct consumption without preparation. | Lemon pepper, spicy chili, garlic herb, teriyaki | On-the-go meals, lunch kits, and convenience retail | Safe Catch, Starkist Creations, Century Pacific |

| Ready-to-Eat Tuna Meals | Tuna combined with vegetables, grains, or sauces for complete ready meals. | Tuna salads, tuna pasta kits, protein bowls | Convenience meals, office lunches | Bumble Bee Ready to Eat Meals, Starkist Lunch to Go |

| Low Sodium and Healthy Positioning Tuna | Products designed for health-conscious consumers focusing on reduced sodium or clean label. | Low-sodium tuna, no salt-added tuna | Medical nutrition, weight management | Wild Planet Foods, Safe Catch |

| Organic and Sustainable Tuna | Tuna is sourced ethically and certified for eco-friendly fishing practices. | MSC certified, pole and line caught tuna | Premium retail, eco-aware consumers | Ocean Brands, American Tuna, Fish4Ever |

| Canned Tuna in Pouches | Lightweight, no-drain formats offering convenience and portability. | Single-serve tuna pouches, flavored pouches | Sports nutrition, on-the-go snacking | Starkist Pouch, Bumble Bee Prime Fillet Pouch |

| Specialty Tuna Cuts and Gourmet Tuna | High-quality tuna products targeted at premium culinary applications. | Ventresca (belly), premium yellowfin fillet cuts | Fine dining retail, gourmet stores | Ortiz, Rio Mare Premium, Tonnino |

| Infused and Functional Tuna Products | Tuna infused with oils, spices, or functional ingredients for enhanced nutrition. | Omega-3-enriched tuna, herb-infused tuna | Functional foods, active lifestyle diets | Safe Catch Elite, private-label fortified lines |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5923

Canned Tuna Market Dynamics

What are the Growth Drivers of the Canned Tuna Market?

The growing population of health-conscious consumers demanding protein-rich options at affordable prices is a major factor driving market growth. Different variants of tuna are versatile enough for preparing a range of simple and gourmet dishes that are rich in protein and omega-3 fatty acids. Canned tuna and other types of tuna, available in innovative, convenient packaging, also help fuel demand for the canned tuna sector.

Challenge

Mercury Contamination May Restrict the Market’s Growth

Mercury levels in canned tuna are generally high, leading to various health issues. They are not recommended for children and pregnant women. Hence, such issues may hamper market growth. Hence, to address such issues, stricter regulations and better labelling are mandatory to ensure the product is safe for consumption.

Opportunity

Premium Flavor Options Are Helpful for the Canned Tuna Industry Growth

The availability of various flavor options, along with traditional canned tuna, is a major opportunity for market growth. Such flavors are highly sought after by consumers and professional kitchens for preparing gourmet cuisine and other delectable recipes. Such flavors also help develop unique and global cuisines, further supporting market growth.

Canned Tuna Market Regional Analysis

Europe Dominated the Canned Tuna Market in 2024

Europe dominated the canned tuna market in 2024, driven by a growing population of health-conscious consumers seeking healthier, sustainable alternatives, which boosted market growth. Higher demand for nutritious seafood available in convenient packaging and ready-to-prepare options, accompanied by sustainable fishing practices, also helps fuel the market's growth. Germany has made a major contribution to the growth of the regional market due to consumer awareness of sustainability, overfishing, increased demand for sustainable sources, and environmental harm.

The Middle East and Africa Are Expected to Grow in the Foreseeable Period

The Middle East and Africa are expected to be the fastest-growing regions over the forecast period due to high demand for healthier, sustainable options. Advanced changes in consumer lifestyles, leading to higher demand for convenient, ready-to-eat options, are another major factor fueling the growth of the canned tuna market in the foreseeable future.

Canned tuna has a longer shelf life and is packed with essential nutrients, including omega-3 fatty acids and protein. Hence, they are highly preferred by consumers. The UAE has made a major contribution to the market's growth in the region due to its affordability, longer shelf life, and multiple health benefits.

North America Is Observed to Have a Notable Growth in the Foreseeable Period

North America is expected to see notable growth in the near term due to rising demand for sustainable, healthier choices. High demand for convenient, ready-to-eat food options with their nutritional qualities intact is another major factor driving the market’s growth. The region also sees growth, as canned tuna offers nutritional benefits, including being rich in omega-3 fatty acids, protein, and other nutrients. The US is a major contributor to the market's growth in the region due to a growing health-conscious population, convenient packaging, and the availability of product variants across online and offline platforms.

Canned Tuna Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 3.1% |

| Market Size in 2025 | USD 34.56 Billion |

| Market Size in 2026 | USD 35.63 Billion |

| Market Size by 2034 | USD 45.49 Billion |

| Dominated Region | Europe |

| Fastest Growing Region | Middle East & Africa |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Canned Tuna Market Segmental Analysis

Species Analysis

The skipjack segment dominated the canned tuna market in 2024, as skipjack is readily available, affordable, and highly preferred by consumers. The tuna variant is low in mercury, high in protein, and has other nutritional content. Hence, it is highly preferred by consumers and is helpful for the market's growth. Higher demand for healthier, sustainable, and convenient options is another major factor driving market growth.

The yellowfin segment is expected to grow over the forecast period due to its high-end quality, form, texture, and strong demand in the gourmet region. The high-end quality of the tuna variant drives strong demand in the premium seafood industry, further fueling market growth in the foreseeable future. The segment is also growing due to a larger population of health-conscious consumers and rising disposable income, enabling them to spend on premium options.

Product Style Analysis

The light tuna segment dominated the canned tuna market in 2024 due to factors such as affordability, high protein, and low fat, which helped drive market growth. The segment also observes growth, as the variant is low in fat and versatile enough to be used in a range of dishes, from a simple sandwich recipe to a gourmet dish.

The white or Albacore tuna segment is expected to grow over the forecast period due to factors such as rising disposable income, higher demand for premium and sustainable options, and a large consumer base seeking a gourmet experience. Consumers seeking high-protein, premium, and light options prefer Albacore tuna, further fueling market growth in the foreseeable future.

Packaging Form Analysis

The metal cans segment dominated the canned tuna market in 2024 as they help to maintain the safety, hygiene, and shelf life of the tuna. Metal cans help keep the tuna protected from moisture, oxygen, and light, which can damage the product. Hence, such factors help fuel the market's growth. The metal cans also help the tuna variant sustain the sterilization process, further fueling market growth.

The pouches, tetra, or flexible packaging segment is expected to grow over the forecast period due to its convenience, portability, and ease of transport and logistics, which help brands enhance their marketing efforts. Such packaging forms allow brands to display their names in large, vibrant fonts for targeted marketing, further fueling market growth. It also allows consumers to carry such pouches easily outdoors, maintain their nutritional status, and avoid unhealthy snacking. Such factors help fuel the market's growth in the foreseeable period.

Distribution Channel Analysis

The supermarkets and hypermarkets segment led the canned tuna market in 2024 due to the availability of a variety of products under one roof, allowing consumers to choose the right one. Products are organized into categories for consumers’ convenience, fueling market growth. The availability of different types of discounts and schemes for bulk purchasing, as well as different tuna brands, are other major factors fueling the growth of the canned tuna sector.

The online segment is expected to grow over the forecast period due to the platform's convenience, allowing consumers to shop for the required product and have it delivered to their homes within minutes. Such platforms also offer a wide product portfolio, allowing consumers to choose the best option, read product reviews and information on new products, and shop smartly. Online platforms also offer multiple discounts to make the shopping experience more economical, which is helpful for the growth of the canned tuna market in the foreseeable future.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Canned Tuna Market

- Frinsa del Noroeste (Frinsa) – A leading Spanish producer of canned tuna and seafood products, known for high-quality sourcing and advanced processing facilities. Frinsa serves European retail and private-label markets with a strong focus on sustainability.

- Jealsa (Jealsa Group) – One of Spain’s largest tuna processors, supplying major retailers across Europe. Jealsa is recognized for responsible fishing practices and value-added canned tuna products.

- Wild Planet Foods – A U.S.-based brand specializing in sustainably caught tuna using pole-and-line and troll fishing methods. The company targets the premium and eco-conscious canned seafood market.

- Aneka Tuna Indonesia – A major Indonesian tuna processor serving global private-label and branded markets. The company produces a wide range of canned tuna formats for export to Europe, the U.S., and the Middle East.

- American Tuna – A U.S. company offering pole-and-line–caught, traceable, and premium canned tuna products. Its products cater to environmentally conscious consumers and specialty retail.

- Ocean Brands GP – A North American seafood company known for tuna brands emphasizing sustainable sourcing. The company supplies major retail chains and foodservice customers.

- Bolton Group – An Italian multinational and one of Europe’s largest canned tuna suppliers through brands like Rio Mare, Saupiquet, and Isabel. Bolton focuses on quality, Mediterranean-style products, and responsible fishing partnerships.

- StarKist Co. – A leading U.S. canned tuna brand offering chunk light, solid white, flavored, and ready-to-eat tuna products. StarKist is a dominant player in mainstream retail channels.

- Dongwon Industries – A major South Korean seafood conglomerate and the parent company of StarKist. Dongwon operates one of the world’s largest tuna fleets and has a strong global footprint in canned tuna production.

- Crown Prince, Inc. – A U.S. importer and distributor offering premium canned seafood, including sustainably sourced tuna. The company focuses on clean-label and wild-caught product lines.

- Natural Sea – A U.S. natural foods brand offering sustainably sourced and mercury-conscious tuna varieties. Its products cater to health-oriented and organic retail channels.

- John West / Princes – A top U.K. canned tuna brand under Princes Group, supplying classic, flavored, and ready-to-eat tuna products. The company is widely distributed across European supermarkets.

- Stark Seafoods – A mid-sized canned seafood producer offering tuna products for retail and foodservice markets. Known for value-oriented offerings and flexible private-label production.

- Carson’s / Rio Mare (Bolton Group) – Carson’s distributes Rio Mare and related Bolton Group brands in various markets. Rio Mare is known for its premium olive oil–packed tuna.

- Pacific Seafood – A major U.S. seafood company with diversified processing, including tuna products. Pacific Seafood serves retail, wholesale, and foodservice channels.

- Tuna Ventures / Local / Artisanal Brands – Smaller and artisanal producers focused on pole-and-line–caught, traceable, and specialty tuna formats. These brands often serve niche, regional, and eco-conscious markets.

Segment Covered in the Report

By Species/Product Type

- Skipjack

- Yellowfin

By Product Style/Type

- Light Tuna

- White / Albacore Tuna

- Flavored vs Unflavored

- Unflavored

- Flavored

By Packaging Format

- Metal Cans

- Pouches / Tetra / Flexible Packaging

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores / Gourmet Retail

- Online / E-commerce

- Foodservice / Institutional (sandwiches, catering, ready meals)

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5923

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.