Stainless Steel Market Size to Worth USD 357.28 Billion by 2034

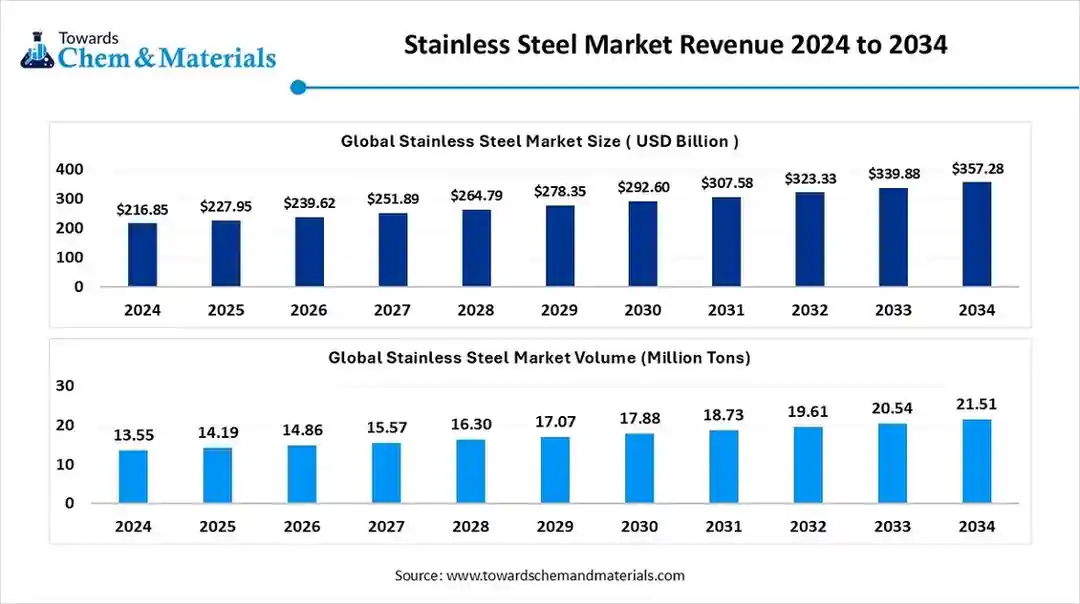

According to Towards Chemical and Materials, the global stainless steel market size is calculated at USD 227.95 billion in 2025 and is expected to be worth around USD 357.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.12% over the forecast period 2025 to 2034.

Ottawa, Oct. 24, 2025 (GLOBE NEWSWIRE) -- The global stainless steel market size was valued at USD 216.85 billion in 2024 and is anticipated to reach around USD 357.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.12% over the forecast period from 2025 to 2034. Asia Pacific dominated the stainless steel market with a market share of 55% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

According to Towards Chemical and Materials, the global stainless steel market stands at 14.19 million tons in 2025 and is forecast to reach 21.51 million tons by 2034, representing a robust CAGR of 4.73 % over the forecast period.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5932

Stainless Steel Overview

The stainless steel market is experiencing robust momentum, driven by strong demand from major sectors such as infrastructure development, automotive component manufacturing and heightened interest in sustainable materials production. A key catalyst is the accelerated pace of urbanisation and industrial expansion particularly in the Asia Pacific region where large scale contruction projects and expanding vehicle production are raising the need for cosrrosion resistant, long lasting alloys, at the same time, changes in manufacturing technology and increasing emphasis on eco-friendly production are shaping the competitive landscape, producers are investing in processes with higher recycled content, energy-efficient operations and advanced steel grades tailored for high performance applications.

Stainless Steel Market Report Highlights

- By region, Asia Pacific held approximately a 55% share in the stainless steel market in 2024.

- By type, the austenitic stainless steel segment held approximately a 52% share in the market in 2024.

- By product form, the flat products segment held approximately a 55% share in the market in 2024.

- By end-use industry, the construction & infrastructure segment held approximately a 45% share in the market in 2024.

- By manufacturing process, the hot rolling segment held approximately a 50% share in the market in 2024.

How Stainless Steel Market is Made

The exact process for a grade of stainless steel will differ in the later stages. How a grade of steel is shaped, worked and finished plays a significant role in determining how it looks and performs.

Before you can create a deliverable steel product, you must first create the molten alloy.

Because of this most steel grade share common starting steps.

Step 1: Melting

Manufacturing stainless steel starts with melting scrap metals and additives in an electric arc furnace (EAF). Using high-power electrodes, the EAF heats the metals over the course of many hours to create a molten, fluid mixture.

As stainless steel is 100% recyclable, many stainless orders contain as much as 60% recycled steel. This helps to not only control costs but reduce environmental impact.

Exact temperatures will vary based on the grade of steel created.

Step 2: Removing Carbon Content

Carbon helps to increase the hardness and strength of iron. However, too much carbon can create problems—such as carbide precipitation during welding.

Before casting molten stainless steel, calibration and reduction of carbon content to the proper level is essential.

There are two ways foundries control carbon content.

The first is through Argon Oxygen Decarburization (AOD). Injecting an argon gas mixture into the molten steel reduces carbon content with minimal loss of other essential elements.

The other method used is Vacuum Oxygen Decarburization (VOD). In this method, molten steel is transferred to another chamber where oxygen is injected into the steel while heat is applied. A vacuum then removes vented gases from the chamber, further reducing carbon content.

Both methods offer precise control of carbon content to ensure a proper mixture and exact characteristics in the final stainless steel product.

Step 3: Tuning

After reducing carbon, a final balancing and homogenization of temperature and chemistry occurs. This ensures that the metal meets requirements for its intended grade and that the steel’s composition is consistent throughout the batch.

Samples are tested and analyzed. Adjustments are then made until the mixture meets the required standard.

Step 4: Forming or Casting

With the molten steel created, the foundry must now create the primitive shape used to cool and work the steel. The exact shape and dimensions will depend on the final product.

Common shapes include:

- Blooms

- Billets

- Slabs

- Rods

- Tubes

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5932

Stainless Steel Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 239.62 billion |

| Revenue forecast in 2034 | USD 357.28 billion |

| Growth rate | CAGR of 5.12% from 2024 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative Units | Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Type / Grade, By Product Form, By End-Use Industry, By Manufacturing Process, By Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; U.K.; France; Russia; Italy; Spain; Turkey; China; India; Japan; South Korea; Indonesia; Brazil; GCC |

| Key companies profiled | Acerinox S.A.; Aperam Stainless; ArcelorMittal; Baosteel Group; Jindal Stainless; Nippon Steel Corp.; Outokumpu; POSCO; ThyssenKrupp Stainless GmbH; Yieh United Steel Corp. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

General Properties of Stainless Steel

-

Aesthetics

Stainless steel has a great variety of surface finishes, from matt to bright and including brushed and engraved. It can be embossed or tinted, making stainless a unique and aesthetic material. It is often used by architects for building envelopes, interior design and street furniture.

-

Mechanical Properties

Compared to other materials, stainless steel has strong mechanical properties at ambient temperatures – it is steel after all! In particular, it combines ductility, elasticity and hardness, enabling it to be used in difficult metal forming modes (deep stamping, flat bending, extrusion, etc.) while offering resistance to heavy wear (friction, abrasion, impact, elasticity, etc.). Furthermore, it offers good mechanical behaviour at both low and high temperatures.

-

Resistance to Fire

Stainless steel has the best fire resistance of all metallic materials when used in structural applications, having a critical temperature above 800°C. Stainless steel is ranked A2s1d0 for fire resistance with no toxic fume emissivity.

-

Corrosion Resistance

With a minimum chromium content of 10.5%, stainless steel is continuously protected by a passive layer of chromium oxide that forms naturally on the surface through the reaction of the chromium with oxygen from air or water. If the surface is scratched, it regenerates itself. This particularity give stainless steels their corrosion resistance.

-

Cleanability

Stainless steel items are easy to clean, usual cleaning products (detergents, soap powders) are sufficient and do not damage the surface. Stainless steel fully meets the requirements of decoration and cooking utensils that require frequent and effective washing.

-

Recycling

Stainless steel is the “green material” par excellence and is infinitely recyclable. Within the construction sector, its actual recovery rate is close to 100%. It is environmentally neutral and inert when in contact with elements such as water and it does not leach compounds that might modify their composition. These qualities make stainless steel ideally suited to building applications exposed to adverse weather, such as roofs, facades, rainwater recovery systems and domestic water pipes. Stainless steel’s longevity fulfils the requirements of sustainable construction, and effective erection, installation and low maintenance guarantee the user an unrivalled service life.

Stainless Steel Families

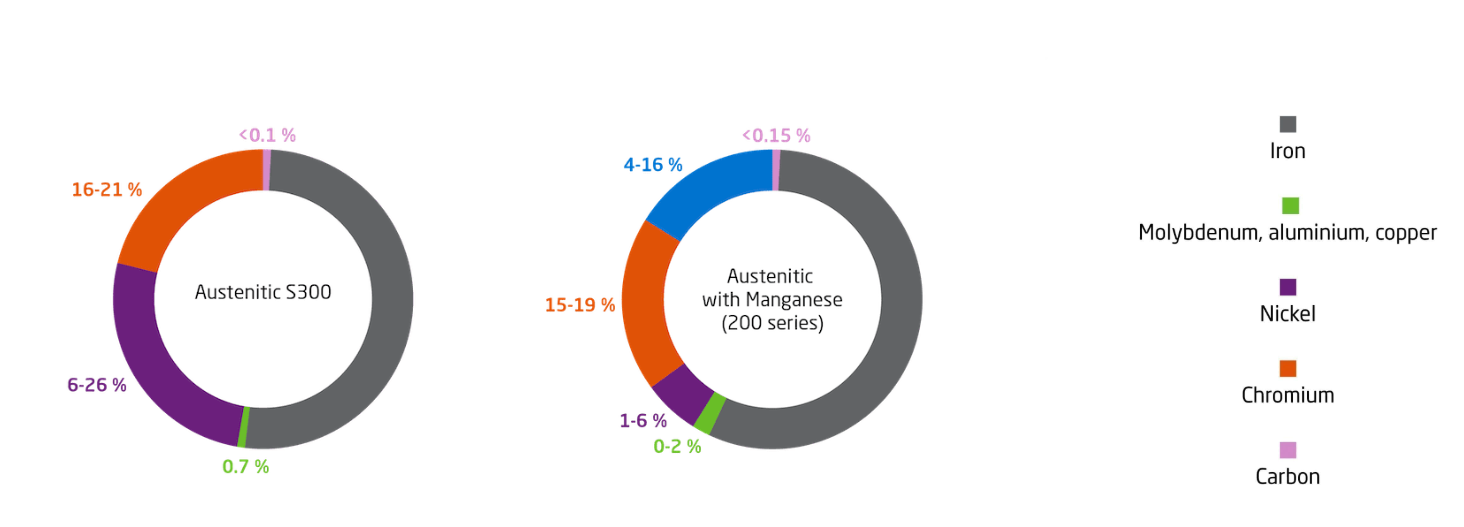

With five categories of stainless steels available – each differentiated by the alloying elements added to iron, carbon and chromium – we offer a complete range of solutions.

- Austenitics or 300 series ;0.015 to 0.10% carbon, 16 to 21% chromium, 6 to 26% nickel, 0 to 7% molybdenum. The presence of nickel improves corrosion resistance in certain media and makes stainless steel more ductile. The presence of molybdenum further enhances the resistance to corrosion in an acid medium. The most common grades are 304/304L and 316/316L.

- Applications : Boiler market, aeronautics, electronic components, railway equipment, tubes, chemical tanks and food vats, marine applications, containers, etc.

- Austenitics with manganese or 200 series :These are chromium manganese steels, with a low nickel content (always below 5%).

- Applications : Asphalt tankers, tubes, food containers, silos, conveyor chains, safety soles, etc.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5932

Here Are Some Of The Top Products In The Stainless Steel Market

1. Stainless Steel Coils & Sheets (Flat Products)

- Widely used in automotive, appliances, construction, and industrial equipment.

2. Stainless Steel Pipes & Tubes

- Critical in oil & gas, petrochemicals, water treatment, and construction.

3. Stainless Steel Bars & Rods (Long Products)

- Used in construction, machinery, and tooling applications.

4. Stainless Steel Wire & Wire Rods

- Applications in springs, fasteners, kitchenware, and welding electrodes.

5. Stainless Steel Plates

- Heavy-duty applications in shipbuilding, pressure vessels, and heavy machinery.

6. Precision Stainless Strips

- Used in electronics, medical devices, and automotive components.

7. Stainless Steel Rebars

- Corrosion-resistant reinforcement for bridges, highways, and coastal construction.

8. Duplex and Super Duplex Stainless Steel

- High corrosion resistance for offshore, marine, and chemical industries.

9. Stainless Steel Foils

- Thin, flexible steel used in electronics, batteries, and packaging.

10. Specialty Stainless Alloys (e.g., Austenitic, Ferritic, Martensitic Grades)

- Tailored for high-heat, corrosion, or strength applications in aerospace, defense, and energy.

What Are The Major Trends In The Stainless Steel Market?

- Growing shift towards sustainability and green manufacturing, with greater use of recycled material content and low carbon electricity across stainless steel production lines.

- Rising demand from high performance applications as electric vehicles, renewable energy infrastructure and advanced industrial equipment, driving adoption of specialised stainless steel grades.

- Increased use of advanced manufacturing technologies enabling more complex, custom stainless steel components while reducing waste.

- Expansion of market share in emerging regions, particularly Asia Pacific, driven by urbanisation, industrial growth and infrastructure development.

- Growing preference for specialised stainless steel product forms to meet evolving end use demands in sectors like automotive and oil and gas.

How Does AI Influence The Growth Of The Stainless Steel Market In 2025?

The adoption of AI across the stainless steel value chain is accelerating market expansion by enabling smarter manufacturing, cleaner production and higher performance materials. In production plants, AI-driven systems monitor sensor data from furnaces, rolling mills and finishing lines to optimise process parameters in real time, reducing defects and enhancing yield. AI also underpins predictive maintenance capabilities, allowing manufacturers to anticipate equipment failures and avoid unplanned downtime, which improves throughput and reliability. On the materials side, machine learning models aid alloy development by simulating compositions and processing routes, accelerating the introduction of advanced grades that meet emerging demands in sectors like infrastructure, mobility and energy.

Market Opportunity

Could Renewable Energy Infrastructure Open A New Frontier For Stainless Steel?

The growth of wind, solar and other renewable energy projects is increasing demand for materials that can endure harsh environments and stainless steel is well suited due to its corrosion resistance and durability. Components like turbine towers, solar frames, and supporting structures require long service life with minimal maintenance, making stainless steel an ideal choice. This creates opportunities for manufacturers to expand their presence in energy infrastructure. Aligning material development with renewable energy needs can increase adoption.it positions stainless steel as a key material for sustainable and reliable energy solutions.

Could Green Steel Credential Become A Premium Opportunity For Stainless Steel Makers?

Sectors like construction, automotive, and manufacturing are prioritizing sustainable materials, giving stainless steel with low carbon footprints and high recycled content an edge. Verified emission reductions and transparency in production are becoming procurement priorities. Stainless steel producers can capitalize by offering environmentally responsible grades. Investing in cleaner production and circular economy practices creates a competitive advantage. This opens market opportunities based on sustainability as a core value, not just performance or cost.

Limitations In The Stainless Steel Market

- Volatility in nickel, chromium, and other key materials affects production costs and pricing creating challenges for manufacturers.

- Tariffs and anti-dumping disrupt global trade and reduce market access for producers.

Stainless Steel Market Segmentation Insights

Type Insights

Why Is Austenitic Stainless Steel Segment Dominating In Stainless Steel Market?

The austenitic stainless steel segment accounted for a largest share of the market in 2024. This is primarily because austentic grades offer excellent corrosion resistance, high strength, and versatility across numerous applications including construction, automotive, and household appliances. Manufacturers value austenitic stainless steel for its adaptability of different fabrication processes and its ability to withstand harsh environments, which ensures lng term reliability in critical applications.

The duplex/super-duplex stainless steel segment is projected to experience the highest growth rate in the market between 2025 and 2034. Duplex grades are gaining traction because of their superior strength, resistance to stress corrosion, and excellent durability in aggressive environments such as offshore and chemical processing applications. The rising adoption of these advanced stainless steels in industries requiring high performance and long lasting materials is fuelling their rapid market growth.

Product Form Insights

Why Are Flat Products Segment Dominating In Stainless Steel Market?

The flat products segment accounted for a large share of the market in 2024. Flat products are widely used in construction, automotive panels, household appliances, and machinery components due to their ease of fabrication and versatility. Their extensive applicability across multiple industries ensures steady demand and contributes to their dominant market position. Manufacturers often prefer flat products for structural and finishing applications, as they can be easily shaped, welded, and coated to meet specific requirements.

The tubing and pipes segment is set to experience the fastest rate of the market growth from 2025 to 2034. Stainless steel tubing and pipes are increasingly used in sectors such as oil and gas, chemicals, and water treatment due to their corrosion resistance and long service life. The expansion of infrastructure projects and industrial plants drives the need for these products, which are essential for safe and reliable fluid transport systems. Additionally, industries are adopting seamless and welded pipes that offer higher strength and lower maintenance costs, further accelerating their growth.

End Use Industry Insights

Why Is Construction And Infrastructure Segment Dominating Stainless Steel Market?

The construction and infrastructure segment dominated the market in 2024. The dominance of this sector is driven by ongoing urbanization, modernization of infrastructure, and large-scale construction projects across the globe. Stainless steel is highly valued in construction for its durability, corrosion resistance, and aesthetic appeal, making it suitable for applications ranging form bridges and high rise building to commercial complexes and transportation hubs. The continues demand for strong, low maintenance materials ensures that construction and infrastructure remain a cornerstone of stainless steel consumption.

The automotive and transportation segment is projected to expand rapidly in the market in the coming years. This growth is fuelled by the rising production of vehicles, including electric and hybrid models, which increasingly require lightweight, durable, and corrosion resistant stainless steel components. Automotive manufacturers are also investing in advanced materials to meet performance, safety, and sustainability requirements, creating string demand for specialized stainless steel grades.

Manufacturing Process Insights

Why Is Hot Rolling Segment Dominating In Stainless Steel Market?

The hot-rolling segment maintained a leading position in the market in 2024. Hot-rolling is widely used because it improves the mechanical properties of stainless steel, enhances surface finish, and allows for large scale production of sheets, plates and coils. The process is efficient for producing high quality flat products that are essential in construction, automotive, and industrial applications. Manufacturers value hot-rolled stainless steel for its uniformity, strength and adaptability to further fabrication processes such as cutting, bending, and welding.

The cold rolling segment is expected to grow with the highest CAGR in the market during the studied years. Cold-rolling enhances surface finish, dimensional accuracy, and mechanical properties, making it ideal for applications that require precise and high quality stainless steel sheets and coils. The process is increasingly adopted in automotive panels, appliances, and high performance industrial components due to the superior strength and finish it provides. Rising demand for aesthetically refined and technically demanding stainless steel products is accelerating the adoption of col-rolling technology.

Regional Insights

What Makes Asia Pacific The Dominant Region In The Stainless Steel Market?

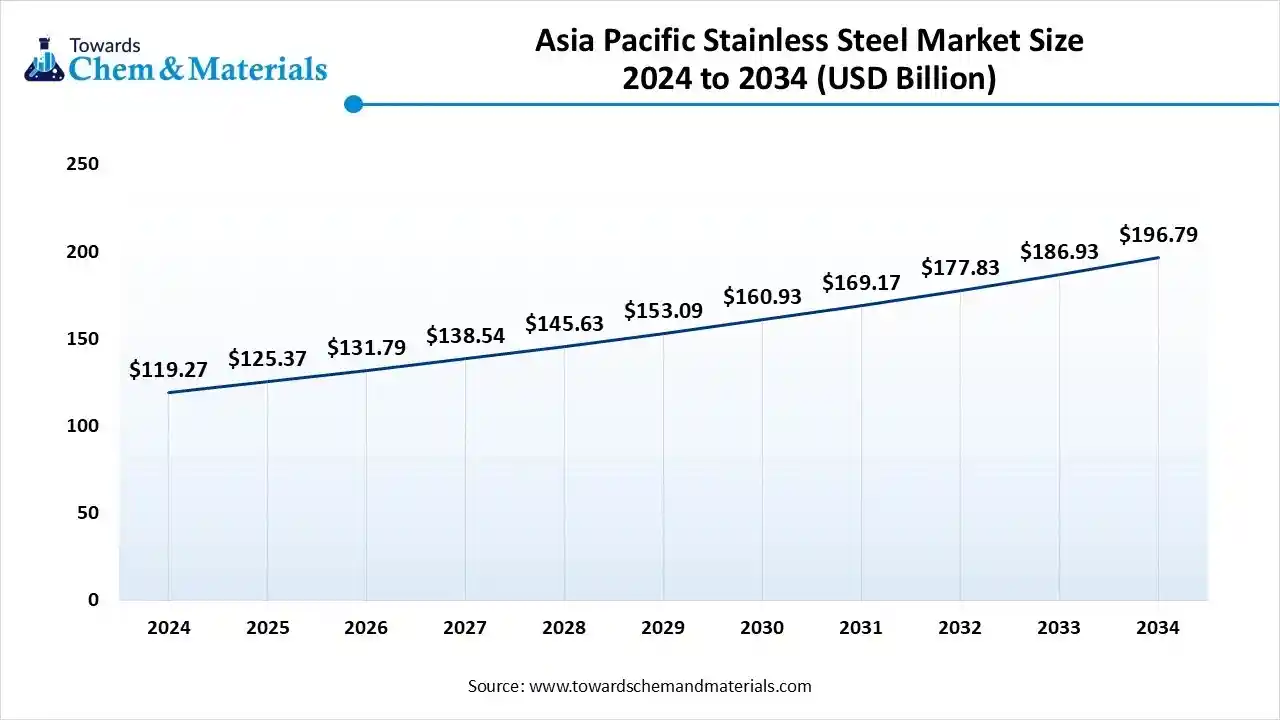

The Asia Pacific stainless steel market size is estimated at USD 125.37 billion in 2025 and is projected to reach USD 196.79 billion by 2034, growing at a CAGR of 5.14%% from 2025 to 2034. Asia Pacific dominated the stainless steel market with approximately 55% share in 2024.

Asia Pacific dominated the market in 2024, driven by rapid urbanization, robust infrastructure development, and substantial industrial activities. The region’s dominance is underpinned by its extensive manufacturing capabilities and significant consumption across various sectors. Countries within this region are investing heavily in infrastructure projects such as airports, highways, and railways, which in turn boosts the demand for stainless steel. Additionally, the growth of the construction and automotive industries further propels the market. This strategic focus on industrialization and development solidifies. Asia Pacific’s leadership in the stainless steel market.

China stands out as a pivotal force in the stainless steel market, owing to its substantial production capacity and extensive consumption. The country’s industrial sector, particularly in construction and manufacturing, drives a significant portion of global demand for stainless steel. Chain’s strategic investments in infrastructure and industrialization have positioned it as a central hub for stainless steel production and consumption. These factors contribute to China’s influential role in shaping global market trends and dynamics.

Why Is North America The Fastest Growing Region In The Stainless Steel Market?

North America is experiencing rapid growth in the stainless steel market, driven by significant infrastructure development, industrial expansion, and a resurgence in manufacturing activities. The region’s emphasis on upgrading aging infrastructure and increasing investments in sectors like automotive, aerospace, and energy are contributing to the rising demand for high quality, durable materials such as stainless steel. This trend is further supported by favourable trade policies and a focus on sustainable construction practices, positioning north America as a key player in the market.

The United States stands out as a major contributor to the North American stainless steel market, owing to its robust industrial base and substantial consumption across various sectors. Key industries such as automotive, construction, and manufacturing are driving the demand for stainless steel, with the U.S. accounting for a significant share of the regional market. The country’s focus on infrastructure modernization, coupled with advancements in manufacturing technologies reinforces its position as a dominant force in the stainless steel industry.

Stainless Steel Market Top Companies

- Thyssenkrupp AG: Major European producer; its Stainless division (now part of Outokumpu) was a key player in high-performance stainless steel.

- Baosteel Group: One of China’s largest stainless steel producers; strong in flat products for automotive and construction.

- Tsingshan Holding Group: World's largest stainless steel producer; vertically integrated, with global mining-to-mill operations.

- Aperam: Leading European stainless producer; focuses on high-end, sustainable stainless solutions.

- ATI (Allegheny Technologies Inc.): U.S.-based; known for specialty stainless and high-performance alloys for aerospace and defense.

- Acerinox: Global stainless leader; strong presence in Europe, Americas, and Africa.

- SAIL: India’s major stainless supplier; growing domestic infrastructure demand.

- NLMK Group: Primarily carbon steel, but contributes niche stainless applications.

- Hyundai Steel: Focuses on stainless for automotive and appliances in South Korea.

- Sandvik AB: Specializes in stainless alloys for industrial, medical, and energy applications.

More Insights in Towards Chemical and Materials:

- Steel Rebar Market : The global steel rebar market stands at 368.91 million tons in 2025 and is forecast to reach 530.10 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period from 2025 to 2034.

- Structural Steel Market : The global structural steel market size was approximately USD 119.12 billion in 2025 and is projected to reach around USD 188.63 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.24% between 2025 and 2034.

- Flat Steel Market ; The flat steel market size accounted for USD 687.55 billion in 2024 and is predicted to increase from USD 724.33 billion in 2025 to approximately USD 1,157.84 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034.

- Green Steel Market : The global green steel-market size was valued at USD 718.55 billion in 2024, grew to USD 763.10 billion in 2025, and is expected to hit around USD 1,311.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.20% over the forecast period from 2025 to 2034.

- Hot Rolled Coil (HRC) Steel Market : The global hot rolled coil (HRC) steel market size accounted for USD 355.42 billion in 2024, grew to USD 375.86 billion in 2025, and is expected to be worth around USD 621.65 billion by 2034, poised to grow at a CAGR of 5.75% between 2025 and 2034.

- U.S. Steel Rebar Market : The U.S. steel rebar market size was estimated at USD 7.31 billion in 2025 and is predicted to increase from USD 7.70 billion in 2026 to approximately USD 11.59 billion by 2034, expanding at a CAGR of 5.25% from 2025 to 2034.

Stainless Steel Market Top Key Companies:

- Thyssenkrupp AG

- Baosteel Group

- Tsingshan Holding Group

- Aperam

- Allegheny Technologies Incorporated (ATI)

- Acerinox

- Steel Authority of India Limited (SAIL)

- NLMK Group

- Hyundai Steel

- Sandvik AB

Recent Developments

- In October 2025, ThyssenKrupp is intensive discussion with Jindal Steel International regarding the potential sale of its steel division, ThyssenKrupp Steel Europe. Jindal has submitted an indicative bid to acquire Europe’s second largest steelmaker, aiming to expand its presence in the European market. The proposed deal includes investment commitments for a green steel production facility, aligning with ThyssenKrupp’s restricting strategy. Discussions are expected to continue over the coming months.

- In October 2025, Jindal stainless has inaugurated its first stainless steel fabrication in Mumbai, with an investment of approximately Rs.125 crore. The 4 lakh square feet facility marks a strategic expansion into the stainless steel fabrication sector, enhancing the company’s production capabilities and market presence. This move is part of Jindal Stain less’s efforts to diversify its operations and meet growing demand in the industry.

Stainless Steel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Stainless Steel Market

By Type / Grade

- Austenitic Stainless Steel

- 304 Grade

- 316 Grade

- Ferritic Stainless Steel

- Martensitic Stainless Steel

- Duplex / Super Duplex Stainless Steel

By Product Form

- Flat Products

- Coils & Sheets

- Plates

- Long Products

- Bars & Rods

- Wire

- Tubing & Pipes

By End-Use Industry

- Construction & Infrastructure

- Automotive & Transportation

- Aerospace & Defense

- Food & Beverage / Packaging

- Chemical & Petrochemical

- Medical & Pharmaceutical Equipment

By Manufacturing Process

- Hot Rolling

- Cold Rolling

- Precision Casting

- Forging

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5932

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.